Washington State Department Of Revenue Unclaimed Money

Find your money on Unclaimed Property Day Feb. 1! Washington Department of Revenue

Join the unclaimed property Search-A-Thon Jan. 28 OLYMPIA, Wash. – Jan. 28, 2026 – One in seven people have money from an uncashed check, unused gift certificate, or forgotten safety deposit box waiting for them to claim. Are you one of them?

https://dor.wa.gov/about/news-releases/2026/find-your-money-unclaimed-property-day-feb-1

News Washington Department of Revenue

These contacts are for reporters and members of the news media only...

https://dor.wa.gov/about/news-releases/2026

This is a great website and it’s for funds that I’ve gone unclaimed within Washington state from various vendors or insurance companies you may have used, etc. etc. it’s quick and easy to file a claim...

https://www.instagram.com/reel/DUEnjTqjOaq/Washington is... - Washington State Department of Revenue Facebook

Washington is proud to join the National Unclaimed Property Day Search-a-thon on Jan 28, 2026! Discover all about unclaimed property and see what’s waiting for you.

https://www.facebook.com/WARevenue/posts/washington-is-proud-to-join-the-national-unclaimed-property-day-search-a-thon-on/1335618461941870/

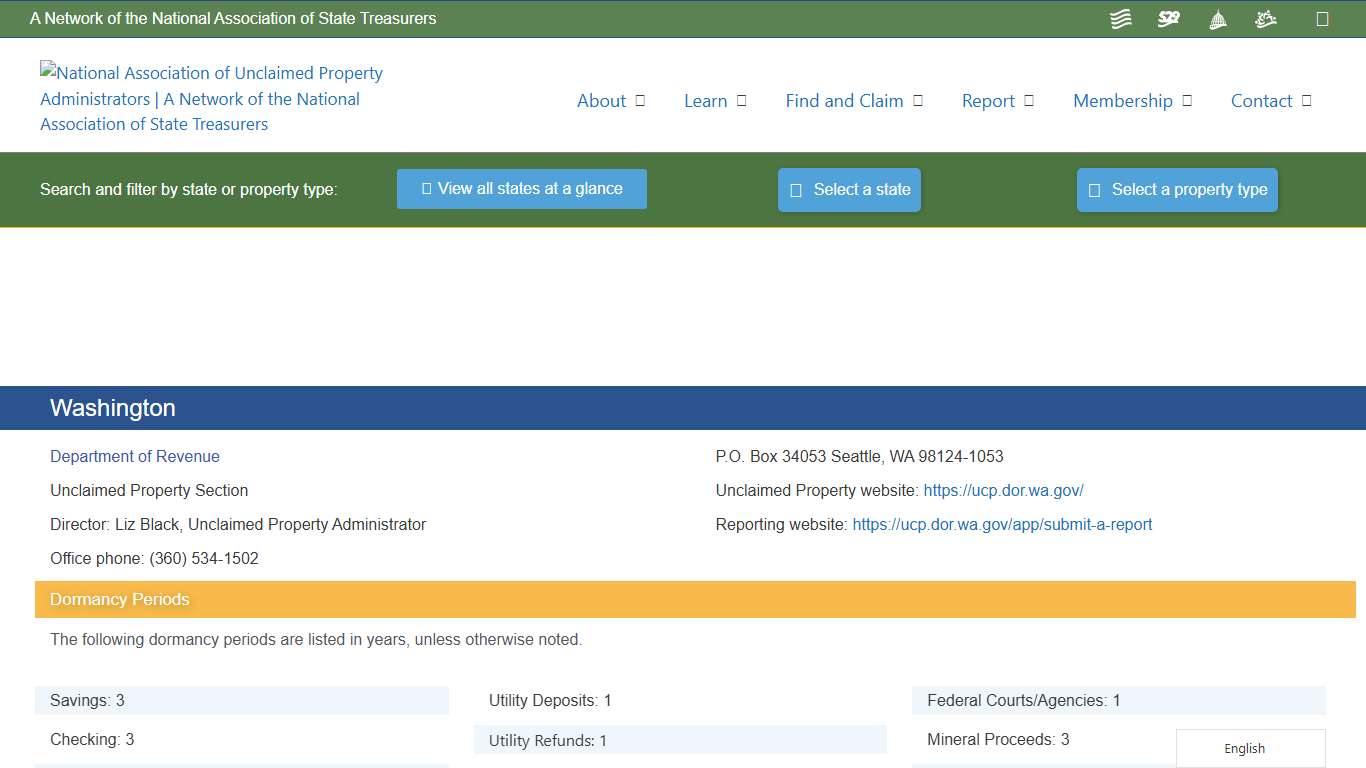

Washington – National Association of Unclaimed Property Administrators (NAUPA)

Dormancy Periods The following dormancy periods are listed in years, unless otherwise noted. Reporting and Payment Due Dates The following indicates the report and payment due dates for the various property types. Electronic Reporting Capability Schedule The following indicates which types of reporting formats are accepted by this state.

https://unclaimed.org/reporting/washington/

Understanding Unclaimed Property in Washington State - Cordell Neher & Company, PLLC

Footer Contact Check the background of your financial professional on FINRA's BrokerCheck® Privacy & Usage: The information on the Cordell, Neher & Company, PLLC website is provided with the understanding that it should not be substituted, in any way, for consultation with a professional Certified Public Accountant, accountant, tax, legal or other competent advisor.

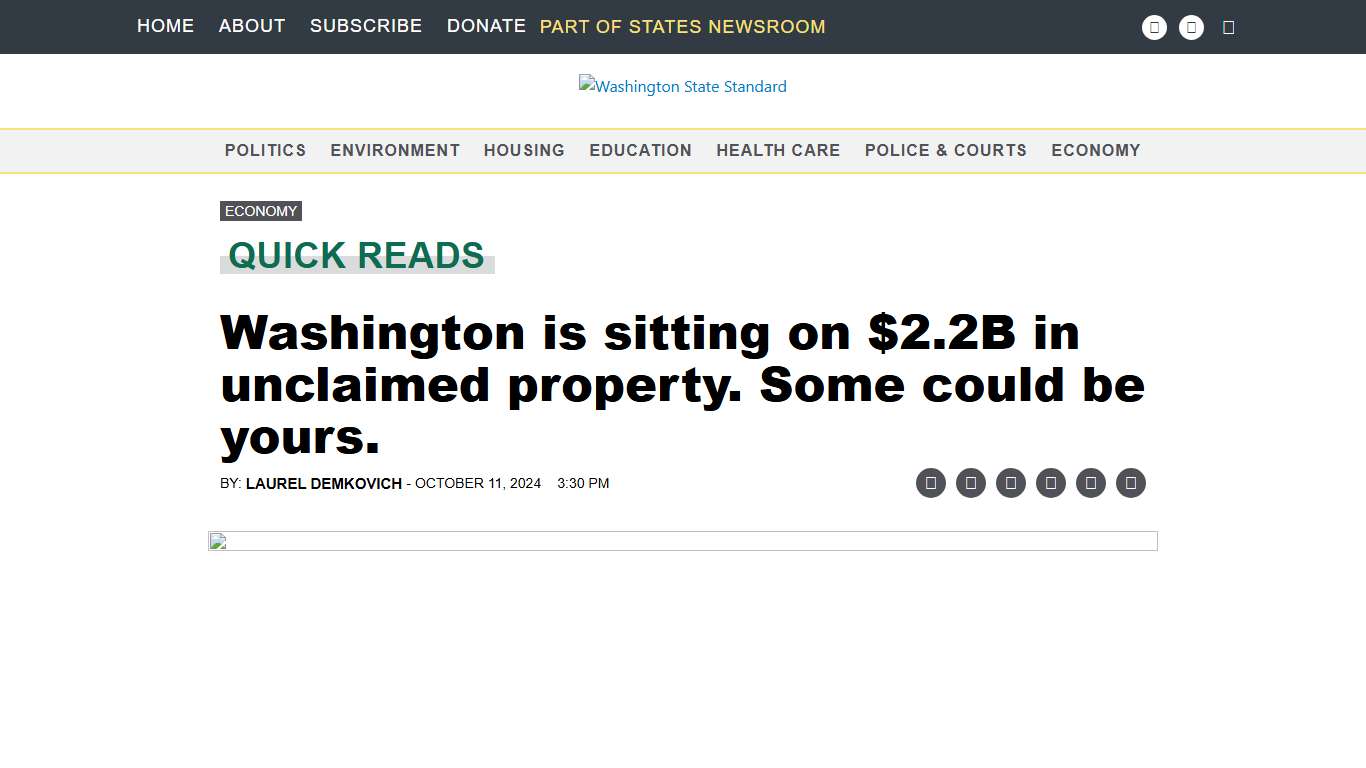

https://cnccpa.com/understanding-unclaimed-property-in-washington-state/Washington is sitting on $2.2B in unclaimed property. Some could be yours. • Washington State Standard

15:30 Brief Does Washington state have money of yours? It’s possible. If a business loses contact with a customer for an extended time, some unclaimed money like security deposits, uncashed paychecks, or the contents of bank accounts or safe deposit boxes is handed over to the state for safekeeping.

https://washingtonstatestandard.com/briefs/washington-is-sitting-on-2-2b-in-unclaimed-property-some-could-be-yours/

The Department of... - Washington State Department of Revenue Facebook

The Department of Revenue will begin accepting Tax Year 2025 applications for the Working Families Tax Credit (WFTC) on Feb. 1, 2026. Click the link for more information: https://dor.wa.gov/.../working-families-tax-credit...

https://www.facebook.com/WARevenue/posts/the-department-of-revenue-will-begin-accepting-tax-year-2025-applications-for-th/1338554214981628/

How to Claim Unclaimed Money in Washington State

I have unclaimed money. They said I have unclaimed money and talk to a lawyer. Washington. I filled out my name email Customer: I have unclaimed money. Lawyer's Assistant: I'll do all I can to help. Can you tell me more about what's going on?

https://www.justanswer.com/law/ex214-unclaimed-money-unclaimed-money.html

National Association of Unclaimed Property Administrators (NAUPA) – The leading, trusted authority in unclaimed property

NAUPA is the leading, trusted authority in unclaimed property. We help individuals claim their unclaimed property, and help businesses ensure compliance per state law in annual reporting. Search for property in your state or province Use the interactive map below or select from the list to find the official unclaimed property program for a state or province.

https://unclaimed.org/

Unclaimed property holder education Washington Department of Revenue

Unclaimed property holder education The department has several types of workshops and videos designed to help your organization report unclaimed property. Each workshop covers the history of unclaimed property, purpose and benefits of the act, preparing and filing your report, and navigating our website.

https://dor.wa.gov/education/events-workshops/unclaimed-property-holder-education

How to find unclaimed property in the State of Washington - Quora

Method 1 of 3:Looking up Unclaimed Property The state of Washington has a convenient online database where you can look to see whether the state is holding property that belongs to you or someone else. Go to: WA Unclaimed Property. You will find spaces to enter your personal information to start the search.

https://www.quora.com/How-do-I-find-unclaimed-property-in-the-State-of-Washington

Before you continue to YouTube

- EnglishUnited States - Deutsch - English - Español - Français - Italiano - Suomi - All languages - Afrikaans - azərbaycan - bosanski - català - Čeština - Cymraeg - Dansk - Deutsch - eesti - EnglishUnited Kingdom - EspañolEspaña - EspañolLatinoamérica - euskara - Filipino - FrançaisCanada - FrançaisFrance - Gaeilge - galego - Hrvatski - Indonesia - isiZulu - íslenska - Italiano - Kiswahili - latviešu -...

https://www.king5.com/article/sponsor-story/claim-your-cash-wa-dept-revenue-unclaimed-property-program/281-1e6611ce-8e7f-4a55-a50a-53626db6e28f

Treasury Auctions U.S. Department of the Treasury

Each year approximately 300 public auctions are conducted throughout the U.S. and Puerto Rico to sell property forfeited as a result of violations of federal law enforced by the Department of the Treasury or nonpayment of Internal Revenue Service taxes. Property auctioned by the Internal Revenue Service (IRS) Treasury Executive Office for Asset Forfeiture (TEOAF) Property seized/forfeited due to violations of federal laws enforced by the U.S.

https://home.treasury.gov/services/treasury-auctions

Home Washington Department of Revenue

Under Engrossed Substitute Senate Bill (ESSB) 5814, the definition of "retail sales" now includes several additional business activities. Since October 1, 2025, businesses have been required to collect and remit sales tax on these services.

https://dor.wa.gov/